Quick Answer

To live securely in Tokyo, you should have $15,000-$100,000+ (¥2.25M-15M+ JPY) in savings depending on your situation. Single individuals need $15,000-$30,000 (¥2.25M-4.5M JPY), couples need $25,000-$50,000 (¥3.75M-7.5M JPY), and families need $50,000-$100,000+ (¥7.5M-15M+ JPY). This includes a 6-12 month emergency fund covering living expenses, plus additional savings for healthcare, housing security, and unexpected costs. Your Tokyo savings target should be 20-30% of your income, with emergency funds kept in liquid Japanese yen accounts for immediate access.

All USD amounts are approximate conversions based on an average exchange rate of 1 USD ≈ 150 JPY. Actual costs may vary.

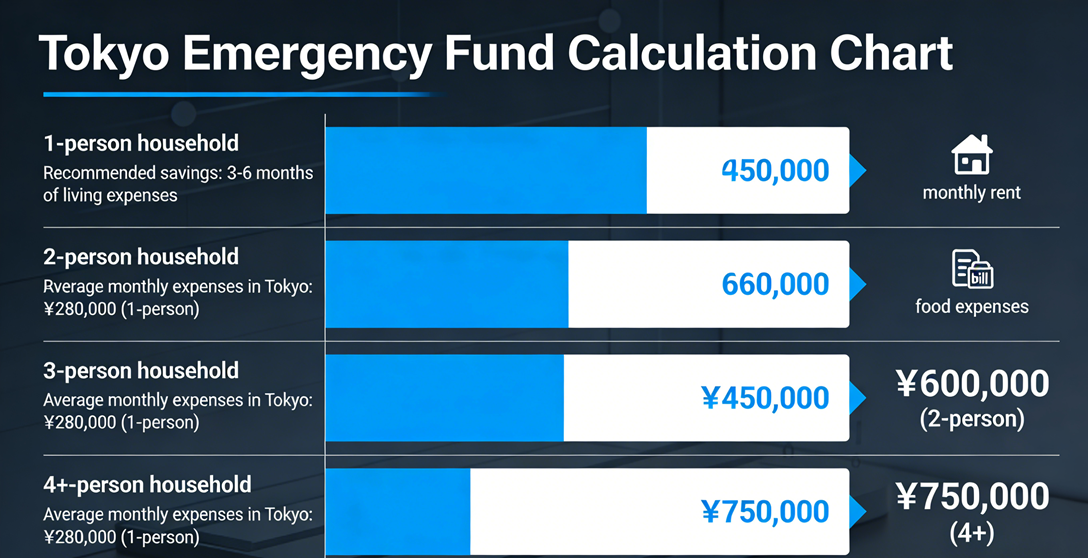

Emergency Fund Requirements for Living in Tokyo

Your Tokyo emergency fund is the most critical savings component, providing financial security against unexpected events. In one of the world's most expensive cities, a substantial cash reserve protects against job loss, medical emergencies, or sudden expenses. Financial advisors recommend 6-12 months of living expenses as an emergency buffer in Tokyo, with additional funds for healthcare deductibles and housing transitions. This guide calculates exactly how much emergency savings you need based on your Tokyo lifestyle and household size.

| Household Type | Monthly Expenses | 6-Month Emergency Fund | 12-Month Emergency Fund | Recommended Minimum |

|---|---|---|---|---|

| Single Person (Frugal) | $1,600 (¥240K JPY) | $9,600 (¥1.44M JPY) | $19,200 (¥2.88M JPY) | $10,000 (¥1.5M JPY) |

| Single Person (Comfortable) | $2,800 (¥420K JPY) | $16,800 (¥2.52M JPY) | $33,600 (¥5.04M JPY) | $18,000 (¥2.7M JPY) |

| Couple (Frugal) | $2,600 (¥390K JPY) | $15,600 (¥2.34M JPY) | $31,200 (¥4.68M JPY) | $16,000 (¥2.4M JPY) |

| Couple (Comfortable) | $4,200 (¥630K JPY) | $25,200 (¥3.78M JPY) | $50,400 (¥7.56M JPY) | $26,000 (¥3.9M JPY) |

| Family of 4 (Frugal) | $4,000 (¥600K JPY) | $24,000 (¥3.6M JPY) | $48,000 (¥7.2M JPY) | $25,000 (¥3.75M JPY) |

| Family of 4 (Comfortable) | $6,500 (¥975K JPY) | $39,000 (¥5.85M JPY) | $78,000 (¥11.7M JPY) | $40,000 (¥6M JPY) |

When You'll Need Your Tokyo Emergency Fund

Common emergency situations in Tokyo requiring savings: Job loss or transition (1-6 months job search average), Medical emergencies (30% co-pay even with national insurance), Unexpected housing issues (need to move quickly, repairs not covered by insurance), Family emergencies (last-minute international flights), Natural disasters (earthquake preparedness, temporary evacuation costs), Legal/visa issues (unexpected documentation or lawyer fees). Japan's social safety nets have limitations for foreigners, making personal emergency savings essential for Tokyo residents.

Where to Keep Your Tokyo Emergency Fund

Keep your Tokyo emergency fund in liquid Japanese yen accounts: Japanese high-yield savings accounts (0.1-0.3% interest), Separate bank accounts from daily spending, Immediate access accounts (no withdrawal penalties), Digital banks with good mobile access. Avoid locking emergency funds in fixed deposits or investments with withdrawal restrictions. Consider keeping 1-2 months expenses in cash at home for true emergencies (earthquake preparation). Maintain foreign currency portion for international emergencies.

Emergency Fund vs Other Savings in Tokyo

Emergency fund is for unexpected crises, other savings are for planned goals. Keep separate accounts. Emergency fund characteristics: liquid, conservative, immediately accessible. Other savings: can be invested, longer-term, goal-specific. Build emergency fund first, then other savings. Never use emergency fund for planned expenses. Replenish immediately if used. Your Tokyo financial security depends on maintaining this separation and discipline.

Tokyo Savings Targets: How Much You Should Have by Situation

Tokyo savings targets vary significantly based on household size, income level, and lifestyle goals. This comprehensive guide provides specific savings benchmarks for different situations in Tokyo, from recent graduates to established professionals and families. Understanding these Tokyo financial milestones helps you plan your savings strategy and measure your progress toward financial security in Japan's capital.

Tokyo Savings Targets by Age and Situation

| Situation/Age | Emergency Fund Target | Retirement Savings | Other Savings Goals | Total Savings Target |

|---|---|---|---|---|

| 20-29 (Single Entry Level) | $10,800 (¥1.62M JPY) | $5,000-$15,000 (¥750K-2.25M JPY) | $5,000 (¥750K JPY) | $20,000-$30,000 (¥3M-4.5M JPY) |

| 30-39 (Single Professional) | $16,800 (¥2.52M JPY) | $30,000-$60,000 (¥4.5M-9M JPY) | $10,000-$20,000 (¥1.5M-3M JPY) | $50,000-$100,000 (¥7.5M-15M JPY) |

| 40-49 (Established Professional) | $21,600 (¥3.24M JPY) | $100,000-$200,000 (¥15M-30M JPY) | $30,000-$50,000 (¥4.5M-7.5M JPY) | $150,000-$270,000 (¥22.5M-40.5M JPY) |

| 20-29 (Couple DINK) | $16,800 (¥2.52M JPY) | $10,000-$30,000 (¥1.5M-4.5M JPY) | $10,000 (¥1.5M JPY) | $35,000-$55,000 (¥5.25M-8.25M JPY) |

| 30-39 (Couple with 1 Child) | $27,000 (¥4.05M JPY) | $60,000-$120,000 (¥9M-18M JPY) | $20,000-$40,000 (¥3M-6M JPY) | $100,000-$190,000 (¥15M-28.5M JPY) |

| 40-49 (Family with 2 Children) | $39,000 (¥5.85M JPY) | $200,000-$400,000 (¥30M-60M JPY) | $50,000-$100,000 (¥7.5M-15M JPY) | $300,000-$540,000 (¥45M-81M JPY) |

| 50-59 (Pre-Retirement) | $54,000 (¥8.1M JPY) | $500,000-$1,000,000 (¥75M-150M JPY) | $100,000-$200,000 (¥15M-30M JPY) | $650,000-$1,250,000 (¥97.5M-187.5M JPY) |

Savings Milestones for Tokyo Residents

First milestone: 1 month expenses saved ($1,600-$6,500/¥240K-975K JPY). Second milestone: 3 months expenses ($4,800-$19,500/¥720K-2.93M JPY). Third milestone: 6 months emergency fund ($9,600-$39,000/¥1.44M-5.85M JPY). Fourth milestone: 12 months emergency fund ($19,200-$78,000/¥2.88M-11.7M JPY). Fifth milestone: Emergency fund + ¥1M JPY ($6,600) additional savings. Sixth milestone: Emergency fund + ¥5M JPY ($33,000) additional savings. Celebrate each Tokyo savings milestone to maintain motivation.

Savings Adequacy Assessment for Tokyo Living

Assess your Tokyo savings adequacy: 1. Emergency fund ratio: Emergency savings ÷ monthly expenses = months covered (target: 6-12). 2. Savings rate: Monthly savings ÷ monthly income (target: 20-30%). 3. Net worth growth: Annual increase (target: 10-15%). 4. Debt-to-savings ratio: Total debt ÷ total savings (target: below 1). 5. Retirement readiness: Current retirement savings ÷ annual income (target by age: 30: 1x, 40: 3x, 50: 6x, 60: 8x). Regular assessment ensures financial security in Tokyo.

Monthly Saving Strategies for Tokyo Residents

Monthly saving in Tokyo requires strategic planning given the city's high living costs. Successful savers in Tokyo follow the 50/30/20 rule (50% needs, 30% wants, 20% savings) or more aggressive 60/20/20 rule (60% needs, 20% wants, 20% savings). This section provides practical monthly saving strategies, target percentages, and automation techniques to build your Tokyo savings consistently, even on moderate incomes.

Monthly Saving Targets Based on Tokyo Income

| Monthly Income After Tax | 20% Savings Target | 30% Savings Target | 50% Savings Target | Recommended Allocation |

|---|---|---|---|---|

| $2,500 (¥375K JPY) | $500 (¥75K JPY) | $750 (¥112.5K JPY) | $1,250 (¥187.5K JPY) | $500-750 (¥75K-112.5K JPY) |

| $3,500 (¥525K JPY) | $700 (¥105K JPY) | $1,050 (¥157.5K JPY) | $1,750 (¥262.5K JPY) | $700-1,050 (¥105K-157.5K JPY) |

| $5,000 (¥750K JPY) | $1,000 (¥150K JPY) | $1,500 (¥225K JPY) | $2,500 (¥375K JPY) | $1,000-1,500 (¥150K-225K JPY) |

| $7,000 (¥1.05M JPY) | $1,400 (¥210K JPY) | $2,100 (¥315K JPY) | $3,500 (¥525K JPY) | $1,400-2,100 (¥210K-315K JPY) |

| $10,000 (¥1.5M JPY) | $2,000 (¥300K JPY) | $3,000 (¥450K JPY) | $5,000 (¥750K JPY) | $2,000-3,000 (¥300K-450K JPY) |

| $15,000 (¥2.25M JPY) | $3,000 (¥450K JPY) | $4,500 (¥675K JPY) | $7,500 (¥1.125M JPY) | $3,000-4,500 (¥450K-675K JPY) |

Automated Saving Systems for Tokyo Residents

Set up automated saving systems in Tokyo: 1. Salary splitting: Direct deposit percentages to separate accounts. 2. Automatic transfers: Schedule transfers 1-2 days after salary receipt. 3. Round-up apps: Automatically save spare change from purchases. 4. Multiple accounts: Emergency, retirement, goals, taxes. 5. Japanese bank features: Auto-transfer (jido furikae) between accounts. 6. Digital bank features: Savings buckets, goals tracking. Automation ensures consistent Tokyo savings before discretionary spending.

Savings Allocation Strategies for Tokyo Living

Allocate Tokyo savings across categories: 1. Emergency fund: 50% of savings until 6 months reached, then 10%. 2. Retirement: 30% of savings (iDeCo, NISA, corporate DC). 3. Short-term goals: 10% (travel, electronics, gifts). 4. Long-term goals: 10% (housing, education, business). Adjust based on priorities: focus on emergency fund first, then retirement, then other goals. Use separate Tokyo bank accounts for each category to prevent accidental spending.

Retirement Savings Targets for Tokyo Living

Retirement savings in Tokyo require substantial targets due to Japan's high life expectancy and cost of living. The average retirement savings goal for Tokyo residents is ¥30-100 million JPY ($200,000-660,000), with higher targets for comfortable retirement. This section provides age-based retirement savings targets, contribution strategies, and Japan-specific retirement accounts (iDeCo, NISA) to help you build sufficient retirement funds while living in Tokyo.

Age-Based Retirement Savings Targets for Tokyo

| Age | Retirement Savings Target | Monthly Contribution Needed | Japanese Accounts to Use | Progress Check |

|---|---|---|---|---|

| 25 | $5,000-$10,000 (¥750K-1.5M JPY) | $200-$400 (¥30K-60K JPY) | NISA, iDeCo (if eligible) | Just starting |

| 30 | $30,000-$60,000 (¥4.5M-9M JPY) | $500-$1,000 (¥75K-150K JPY) | NISA, iDeCo, Corporate DC | 1x annual income |

| 40 | $100,000-$200,000 (¥15M-30M JPY) | $1,000-$2,000 (¥150K-300K JPY) | iDeCo (max), NISA, Investments | 3x annual income |

| 50 | $250,000-$500,000 (¥37.5M-75M JPY) | $2,000-$4,000 (¥300K-600K JPY) | iDeCo, NISA, Additional investments | 6x annual income |

| 60 | $500,000-$1,000,000 (¥75M-150M JPY) | Catch-up contributions | All available, consider annuities | 8x annual income |

| Retirement Age | $660,000+ (¥100M+ JPY) | Withdrawal phase | Pension, annuities, systematic withdrawals | 10-25x annual expenses |

Japanese Retirement Savings Accounts: iDeCo and NISA

iDeCo (Individual Defined Contribution): Tax-advantaged retirement account. Contributions: ¥12,000-68,000 JPY monthly depending on employment. Tax deduction on contributions, tax-free growth, taxed on withdrawal. NISA (Nippon Individual Savings Account): Tax-free investment account. Regular NISA: ¥1.2M JPY annual limit, 5-year tax-free. Tsumitate NISA: ¥400K JPY annual limit, 20-year tax-free. Growth NISA (2024+): ¥3.6M JPY annual limit. Use both for comprehensive Tokyo retirement planning.

Retirement Withdrawal Strategies for Tokyo

Tokyo retirement withdrawal strategies: 1. 4% rule: Withdraw 4% annually from retirement savings. 2. Bucket strategy: 1-2 years cash, 3-5 years bonds, remainder stocks. 3. Japanese pension integration: National pension (¥65,000/month) + employee pension. 4. Annuity consideration: Guaranteed lifetime income. 5. Healthcare planning: Medical costs increase with age, budget 10-20% for healthcare. 6. Housing considerations: Own outright or budget for rent increases. Plan for 20-30 year retirement in Tokyo.

Housing Down Payment Savings for Tokyo Properties

Housing down payment savings in Tokyo represent a major financial goal for residents. With average apartment prices of ¥50-100 million JPY ($330,000-660,000) in central areas, substantial savings are required for property purchase. This section breaks down down payment requirements, additional costs, and savings timelines for buying property in Tokyo, including first-time buyer programs and financing options for foreigners.

Tokyo Property Down Payment Requirements

| Property Price | 10% Down Payment | 20% Down Payment | Additional Costs (4-6%) | Total Initial Savings Needed |

|---|---|---|---|---|

| ¥30M JPY ($200,000) | ¥3M JPY ($20,000) | ¥6M JPY ($40,000) | ¥1.2M-1.8M JPY ($8,000-12,000) | ¥4.2M-7.8M JPY ($28,000-52,000) |

| ¥50M JPY ($330,000) | ¥5M JPY ($33,000) | ¥10M JPY ($66,000) | ¥2M-3M JPY ($13,200-19,800) | ¥7M-13M JPY ($46,200-85,800) |

| ¥70M JPY ($462,000) | ¥7M JPY ($46,200) | ¥14M JPY ($92,400) | ¥2.8M-4.2M JPY ($18,480-27,720) | ¥9.8M-18.2M JPY ($64,680-120,120) |

| ¥100M JPY ($660,000) | ¥10M JPY ($66,000) | ¥20M JPY ($132,000) | ¥4M-6M JPY ($26,400-39,600) | ¥14M-26M JPY ($92,400-171,600) |

Monthly Savings Plan for Tokyo Down Payment

Tokyo down payment savings plan: To save ¥10M JPY ($66,000) in 5 years: save ¥166,667 JPY ($1,100) monthly. In 7 years: save ¥119,048 JPY ($785) monthly. In 10 years: save ¥83,333 JPY ($550) monthly. Acceleration strategies: 1. Increase income with side jobs. 2. Reduce rent costs (share house, suburban area). 3. Cut discretionary spending. 4. Invest savings conservatively. 5. Consider employer housing loans. 6. Look for first-time buyer programs with lower down payments. Automate monthly transfers to dedicated Tokyo housing savings account.

Financing Options for Foreigners Buying in Tokyo

Financing options for Tokyo property: 1. Japanese banks: Require 10-20% down, permanent residency or long-term visa, stable income. 2. International banks: Higher down payments (30-50%), higher interest. 3. Employer loans: Some companies offer housing loans. 4. Seller financing: Rare, possible for older properties. 5. First-time buyer programs: Lower down payments, better rates for eligible buyers. Build strong credit history in Japan, maintain stable employment, and save substantial down payment for best Tokyo mortgage options.

Tokyo Banking Options for Savings and Investments

Tokyo banking options significantly impact your savings growth and accessibility. Japan offers traditional banks, digital banks, and specialized accounts for foreigners. Choosing the right Tokyo savings accounts with good interest rates, low fees, and English support helps maximize your savings while living in Japan. This section compares the best banking options for emergency funds, daily banking, and long-term savings in Tokyo.

Best Savings Accounts for Tokyo Residents

| Bank/Institution | Account Type | Interest Rate | English Support | Best For |

|---|---|---|---|---|

| Japan Post Bank | Yu-cho Savings | 0.001-0.1% | Limited | Emergency fund, accessibility |

| Shinsei Bank | PowerFlex | 0.02-0.1% | Excellent | Foreigners, multi-currency |

| Sony Bank | Online Savings | 0.1-0.3% | Good | Higher interest, online |

| Rakuten Bank | Super Loan & Savings | 0.1-0.25% | Moderate | High yield, Rakuten ecosystem |

| SMBC Trust Bank | Prestia Savings | 0.001-0.05% | Excellent | Expats, wealth management |

| Seven Bank | ATM Savings | 0.02-0.1% | Limited | Convenience, 7-Eleven ATMs |

Setting Up Your Tokyo Banking System

Tokyo banking system setup: 1. Daily account: For salary, bills, daily spending (Shinsei, SMBC, MUFG). 2. Emergency fund account: High-yield, separate institution (Sony, Rakuten). 3. Savings goals accounts: Separate accounts for housing, travel, etc. 4. Investment accounts: NISA, iDeCo, brokerage (SBI, Rakuten Securities). 5. Foreign currency accounts: For international transactions. Use automatic transfers between accounts. Maintain 3-6 months of statements for visa renewals. Keep documents organized for Tokyo financial management.

Digital Banking Options for Tokyo Savers

Digital banking in Tokyo: Revolut Japan: Multi-currency, good exchange rates, budgeting tools. Wise (TransferWise): Borderless account, international transfers. PayPay Bank: Formerly Japan Net Bank, online-only. Aeon Bank: Online with Aeon retail access. Jibun Bank: Mobile-first, good for young savers. Advantages: higher interest rates, lower fees, better apps. Disadvantages: limited branch access, cash deposit challenges. Use digital banks alongside traditional for comprehensive Tokyo financial system.

Tokyo Saving Strategies: Practical Money-Saving Techniques

Tokyo saving strategies help residents build substantial savings despite high living costs. Implementing these practical money-saving techniques can free up 20-50% of income for savings goals. From housing hacks to daily expense optimization, this section provides actionable strategies to increase your savings rate while maintaining quality of life in Tokyo.

Comprehensive Tokyo Saving Strategies by Category

| Category | Strategy | Monthly Savings | Difficulty | Impact |

|---|---|---|---|---|

| Housing | Share house, suburban area, older building | ¥30,000-100,000 JPY ($200-660) | Medium | High |

| Food | Cook at home, lunch specials, discount hours | ¥20,000-50,000 JPY ($132-330) | Low | High |

| Transportation | Bicycle, commuter pass optimization, walk | ¥5,000-20,000 JPY ($33-132) | Low | Medium |

| Utilities | LED lights, efficient appliances, reduce AC | ¥3,000-10,000 JPY ($20-66) | Low | Medium |

| Entertainment | Free events, parks, library, discount days | ¥10,000-30,000 JPY ($66-198) | Low | Medium |

| Shopping | Second-hand, discount stores, point cards | ¥10,000-40,000 JPY ($66-264) | Low | Medium |

| Communication | MVNO sim, WiFi calling, bundle plans | ¥2,000-8,000 JPY ($13-53) | Low | Medium |

| Banking | Fee-free accounts, high-yield savings | ¥500-5,000 JPY ($3-33) | Low | Low |

| Total Monthly Savings | Combined Strategies | ¥80,000-263,000 JPY ($528-1,736) | Varies | Very High |

Automated Saving Systems for Tokyo Residents

Implement automated saving systems in Tokyo: 1. Pay yourself first: Automatic transfer to savings immediately after salary. 2. Round-up apps: Apps that save spare change from purchases. 3. Challenge savings: 52-week challenge, no-spend months. 4. Multiple accounts: Separate accounts for different goals. 5. Cash envelope system: Physical cash for budget categories. 6. Digital envelopes: Banking features that separate funds virtually. Automation reduces decision fatigue and ensures consistent Tokyo savings.

Mindset and Behavioral Strategies for Tokyo Savers

Mindset strategies for Tokyo saving: 1. Value-based spending: Align spending with values, cut the rest. 2. Delay gratification: 30-day rule for non-essential purchases. 3. Visual tracking: Charts, graphs, vision boards for goals. 4. Social accountability: Share goals with friends, join saving groups. 5. Education: Read personal finance books, follow Tokyo finance blogs. 6. Gratitude practice: Appreciate what you have, reduce desire for more. 7. Progress celebration: Reward milestones without undoing progress. Develop Tokyo saver's mindset for long-term success.

Investment Options for Growing Savings in Tokyo

Investment options in Tokyo help grow savings beyond basic bank accounts. Japan offers tax-advantaged accounts (NISA, iDeCo), brokerage services, real estate, and other investment vehicles. Understanding these Tokyo investment options helps you grow your savings efficiently while managing risk appropriately for your financial goals and timeline.

Investment Options Comparison for Tokyo Residents

| Investment Type | Risk Level | Expected Return | Liquidity | Best For |

|---|---|---|---|---|

| Japanese Bank Savings | Very Low | 0.001-0.3% | High | Emergency fund, short-term goals |

| NISA Accounts | Low-High | 3-7% | Medium | Tax-free growth, medium-term |

| iDeCo Retirement | Medium-High | 4-8% | Low (until retirement) | Retirement, long-term tax advantage |

| Japanese ETFs/Stocks | Medium-High | 5-10% | High | Growth, market participation |

| International ETFs | Medium-High | 6-10% | High | Diversification, global growth |

| Japanese REITs | Medium | 3-6% + dividends | Medium | Income, real estate exposure |

| Japanese Bonds | Low | 0.1-2% | Medium | Preservation, low risk |

| Tokyo Real Estate | Medium-High | 4-8% + appreciation | Low | Long-term, tangible assets |

| Crypto Assets | Very High | Highly variable | Medium | Speculation, high risk tolerance |

Building a Tokyo Investment Portfolio

Tokyo investment portfolio construction: 1. Emergency fund: 6 months expenses in cash/savings. 2. Short-term goals (1-3 years): High-yield savings, CDs. 3. Medium-term goals (3-10 years): Balanced ETFs, bonds via NISA. 4. Long-term goals (10+ years): Stock ETFs, iDeCo, real estate. 5. Retirement: iDeCo, NISA, additional brokerage. Allocation by age: 20s-30s: 80-90% stocks, 10-20% bonds. 40s-50s: 60-80% stocks, 20-40% bonds. 50s+: 40-60% stocks, 40-60% bonds. Rebalance annually for Tokyo portfolio management.

Tax-Efficient Investing in Tokyo

Tax-efficient investing in Tokyo: 1. Maximize NISA: ¥1.2-3.6M JPY annual tax-free investments. 2. Utilize iDeCo: Tax deduction on contributions, tax-free growth. 3. Capital gains timing: Hold investments over 1 year for lower tax rates. 4. Tax-loss harvesting: Offset gains with losses. 5. Dividend optimizationForeign tax credits: Claim for international investments. 7. Retirement account priority: iDeCo first (tax deduction), then NISA (tax-free growth), then taxable. Consult tax professional for Tokyo investment tax strategy.

Financial Security Planning for Tokyo Living

Financial security in Tokyo requires comprehensive planning beyond basic savings. A complete Tokyo financial security plan includes emergency funds, insurance coverage, estate planning, and risk management. This section provides a checklist and framework to assess and improve your financial security while living in Tokyo, ensuring protection against life's uncertainties in Japan's capital.

Tokyo Financial Security Checklist

- Emergency Fund: 6-12 months expenses in liquid JPY accounts ✓

- Health Insurance: National Health Insurance enrolled, supplemental if needed ✓

- Life Insurance: Term life coverage if others depend on your income ✓

- Disability Insurance: Income protection if unable to work ✓

- Property Insurance: Renter's or homeowner's insurance, earthquake coverage ✓

- Liability Insurance: Personal liability coverage ✓

- Estate Documents: Will, healthcare directive, power of attorney ✓

- Digital Access

- Debt Management: Manageable debt levels, emergency repayment plan ✓

- Income Streams: Multiple income sources, marketable skills ✓

- Retirement Planning: iDeCo, NISA, additional retirement savings ✓

- Tax Planning: Efficient structure, compliance, optimization ✓

- Legal Compliance: Valid visa, proper registration, tax filings ✓

- Support Network: Professional advisors, community connections ✓

- Regular Review: Annual financial checkup, plan adjustment ✓

Insurance Needs for Tokyo Residents

Essential insurance in Tokyo: 1. National Health Insurance: Mandatory, covers 70% of medical costs. 2. Supplemental Health: Covers remaining 30%, private hospital options. 3. Term Life Insurance: 5-10x income if others depend on you. 4. Disability Insurance: 60-70% income replacement if unable to work. 5. Renter's Insurance (Jibaiseki): Covers belongings, liability, recommended even for rentals. 6. Earthquake InsuranceTravel Insurance: For international trips from Japan. Review coverage annually for Tokyo insurance adequacy.

Estate Planning for Foreigners in Tokyo

Estate planning in Tokyo: 1. Japanese Will: Recommended for assets in Japan, especially real estate. 2. Home Country Will: For assets outside Japan. 3. Healthcare Directive: Medical treatment preferences. 4. Power of Attorney: Financial and healthcare decisions if incapacitated. 5. Beneficiary Designations: Update on accounts, insurance policies. 6. Digital Assets: Instructions for online accounts, cryptocurrencies. 7. Document Storage: Secure location, inform trusted person. 8. International Considerations: Treaties, inheritance laws, taxes. Consult legal professional for Tokyo estate planning.

Frequently Asked Questions: Savings for Tokyo Living

How much savings should I have to live comfortably in Tokyo?

To live comfortably in Tokyo: Single person: $15,000-$30,000 (¥2.25M-4.5M JPY) savings. Couple: $25,000-$50,000 (¥3.75M-7.5M JPY). Family of 4: $50,000-$100,000+ (¥7.5M-15M+ JPY). This includes 6-12 months emergency fund plus additional savings for healthcare, housing security, and unexpected expenses in Tokyo. Actual amount depends on income, lifestyle, and specific Tokyo neighborhood living costs.

What is a good emergency fund for living in Tokyo?

A good Tokyo emergency fund equals 6-12 months of living expenses. Single person: $10,800-$21,600 (¥1.62M-3.24M JPY). Couple: $16,800-$33,600 (¥2.52M-5.04M JPY). Family of 4: $27,000-$54,000 (¥4.05M-8.1M JPY). This covers job loss, medical emergencies, or unexpected expenses while living in Tokyo. Keep in liquid Japanese yen accounts for immediate access. More conservative: 12-18 months for freelancers or those with irregular income.

How many months of expenses should I save for Tokyo?

Save 6-12 months of Tokyo living expenses as financial security. Based on average monthly costs: Singles save $10,800-$21,600 (¥1.62M-3.24M JPY), couples save $16,800-$33,600 (¥2.52M-5.04M JPY), families save $27,000-$54,000 (¥4.05M-8.1M JPY). More conservative: 12-18 months for greater security, especially for freelancers or those with irregular income in Tokyo. This provides buffer for job transitions, emergencies, and unexpected Tokyo expenses.

Is 3 million yen enough to live in Tokyo?

¥3 million JPY ($20,000) is sufficient for a single person to live in Tokyo for 8-12 months with careful budgeting, or 4-6 months for a couple. This covers basic living expenses but provides limited emergency buffer. Not recommended for families or long-term security. Minimum recommended: ¥4.5M+ JPY ($30,000+) for singles, ¥6M+ ($40,000+) for couples for comfortable Tokyo living with proper emergency fund and savings cushion.

How much should I save each month in Tokyo?

Save 20-30% of your Tokyo income monthly. Average targets: Single person earning $3,500/month: save $700-$1,050 (¥105K-157.5K JPY). Couple earning $6,000 combined: save $1,200-$1,800 (¥180K-270K JPY). This builds emergency fund, retirement, and future goals. Higher income allows 30-50% savings rate. Use automatic transfers to separate accounts immediately after receiving Tokyo salary. Adjust based on financial goals and timeline.

What percentage of income should go to savings in Tokyo?

Allocate 20-30% of Tokyo income to savings: 10-15% to emergency fund, 5-10% to retirement (iDeCo/NISA), 5% to other goals. Example: $3,500 monthly income = $700-$1,050 savings. Follow 50/30/20 rule: 50% needs, 30% wants, 20% savings. Adjust based on income: higher earners can save 30-50%. Always prioritize emergency fund before other savings when building Tokyo financial security. Those with debt may allocate differently temporarily.

How much do I need to save for retirement in Tokyo?

Retirement savings target for Tokyo: ¥30-50 million JPY ($200,000-$330,000) for basic retirement, ¥100 million+ ($660,000+) for comfortable retirement. Monthly contribution: $500-$1,500 (¥75K-225K JPY) depending on age and target. Use Japan's iDeCo (corporate/individual) and NISA accounts. Start early: at 30, save $500/month; at 40, save $1,000/month; at 50, save $2,000/month to reach Tokyo retirement goals. Consider additional investments beyond retirement accounts.

How much savings is considered safe in Tokyo?

Safe savings levels in Tokyo: Single person: 6-12 months expenses ($10,800-$21,600/¥1.62M-3.24M JPY) emergency fund plus additional $10,000-$20,000 for other goals. Couple: 6-12 months expenses ($16,800-$33,600/¥2.52M-5.04M JPY) plus $20,000-$40,000 additional. Family: 6-12 months expenses ($27,000-$54,000/¥4.05M-8.1M JPY) plus $40,000-$80,000 additional. This provides financial security against Tokyo's high living costs and unexpected expenses.

Should I keep my savings in yen or foreign currency in Tokyo?

Keep emergency fund (6 months expenses) in Japanese yen for immediate Tokyo access. Long-term savings: diversify 50% JPY, 30% home currency, 20% other currencies. Consider exchange rates, transfer costs, and access needs. For daily Tokyo expenses, use JPY. For retirement/investments, consider multi-currency strategy. Use Japanese bank accounts for daily needs, international accounts/brokers for investments. Monitor exchange rates for optimal transfers between currencies.

How much should I save for a down payment in Tokyo?

Tokyo property down payment: 10-20% of property price. Average Tokyo apartment ¥50M JPY ($330,000) requires ¥5M-10M JPY ($33,000-66,000) down payment. Additional costs: 4-6% closing costs, 2% agent fee, taxes. Total initial: 15-25% of property value. Save ¥100,000-200,000 JPY ($660-1,320) monthly for 3-5 years. First-time buyer programs offer lower down payments. Consider additional savings for renovation (¥1M-3M JPY). Start with down payment fund in high-yield account.

What are the best savings accounts in Tokyo?

Best savings options in Tokyo: Japan Post Bank (accessible, English support), Shinsei Bank (foreigner-friendly, multi-currency), Sony Bank (good rates, online), Rakuten Bank (high-yield options). For emergency fund: high-yield savings accounts (0.1-0.3% interest). For long-term: NISA (tax-free investment accounts), iDeCo (tax-advantaged retirement). Online banks offer better rates than traditional. Consider separate accounts for emergency, retirement, and specific Tokyo savings goals.

How to save money while living in Tokyo?

Save money in Tokyo: 1. Housing: live in suburban areas, share house, UR housing. 2. Food: cook at home, lunch specials, supermarket discounts. 3. Transportation: bicycle, commuter pass, walk. 4. Utilities: reduce AC usage, LED lights, efficient appliances. 5. Entertainment: free events, parks, libraries. 6. Banking: high-yield accounts, fee-free transfers. 7. Shopping: second-hand, discount stores, point cards. 8. Automate savings immediately after Tokyo salary payment.