Quick Answer

Before moving to Tokyo, you need 10,000-40,000 (¥1.5M-6M JPY) depending on your situation. Single individuals need 10,000-15,000 (¥1.5M-2.25M JPY), couples need 15,000-25,000 (¥2.25M-3.75M JPY), and families need 25,000-40,000+ (¥3.75M-6M+ JPY). This includes initial setup costs (8,000-30,000) plus 3-6 months of living expenses as an emergency fund. The largest expense is Tokyo's 4-6 months rent upfront (first month, deposit, key money, agent fees). Always have a financial buffer for unexpected costs during your Tokyo relocation.

All USD amounts are approximate conversions based on an average exchange rate of 1 USD ≈ 150 JPY. Actual costs may vary.

How Much Money You Need Before Moving to Tokyo: Complete Breakdown

Determining how much money you need before moving to Tokyo requires understanding both initial setup costs and ongoing living expenses. Your required savings depend on household size, lifestyle, and housing choices. This comprehensive guide breaks down exactly how much cash you need saved for a successful Tokyo relocation, including emergency funds, visa requirements, and hidden costs most people overlook when budgeting for Japan.

| Situation | Minimum Savings Required | Recommended Savings | Comfortable Savings | What This Covers |

|---|---|---|---|---|

| Single Person | $8,000 (¥1.2M JPY) | 10,000-15,000 (¥1.5M-2.25M JPY) | 15,000-20,000 (¥2.25M-3M JPY) | Shared housing, 3-4 months expenses, basic setup |

| Couple (No Kids) | $12,000 (¥1.8M JPY) | 15,000-25,000 (¥2.25M-3.75M JPY) | 25,000-35,000 (¥3.75M-5.25M JPY) | 1-bedroom apartment, 4-6 months expenses, full setup |

| Family of 3 | $20,000 (¥3M JPY) | 25,000-35,000 (¥3.75M-5.25M JPY) | 35,000-50,000 (¥5.25M-7.5M JPY) | 2-bedroom apartment, 6 months expenses, school costs |

| Family of 4 | $25,000 (¥3.75M JPY) | 30,000-45,000 (¥4.5M-6.75M JPY) | 45,000-65,000 (¥6.75M-9.75M JPY) | 3-bedroom housing, 6+ months expenses, international school |

| Student | $15,000 (¥2.25M JPY) | 20,000-25,000 (¥3M-3.75M JPY) | 25,000-35,000 (¥3.75M-5.25M JPY) | Tuition, housing, 12 months living expenses, visa proof |

| Working Holiday | $3,000 (¥450K JPY) | 5,000-8,000 (¥750K-1.2M JPY) | 10,000-15,000 (¥1.5M-2.25M JPY) | Visa requirement, 3-4 months expenses, travel funds |

Key Factors Determining Your Required Savings

Several key factors determine how much money you need before moving to Tokyo: Housing choice (shared vs private, neighborhood), Employment situation (pre-arranged job vs job hunting), Family size (single vs with dependents), Lifestyle expectations (frugal vs comfortable), Shipping needs (minimal vs full household), and Visa type (work visa requires less savings than student visa). Your Tokyo relocation savings target should account for all these variables with a 20% buffer for unexpected expenses.

The 6-Month Safety Rule for Tokyo Relocation

Financial advisors recommend the 6-month safety rule for moving to Tokyo: Save enough to cover 6 months of Tokyo living expenses plus all initial setup costs. This provides financial security during job transition, apartment hunting, and adjustment period. For a single person: 15,000-20,000 (¥2.25M-3M JPY). For a couple: 25,000-35,000 (¥3.75M-5.25M JPY). For families: 40,000-60,000+ (¥6M-9M+ JPY). This Tokyo emergency fund prevents financial stress during your relocation's critical first months.

Minimum vs Recommended Savings: Understanding the Difference

Minimum savings to move to Tokyo assumes shared housing, no furniture shipping, immediate employment, and strict budgeting. Recommended savings includes private housing, basic furnishings, 3-6 month emergency fund, and realistic adjustment period. Comfortable savings provides private housing in convenient area, full furnishings, 6+ month emergency fund, and leisure budget. Most financial advisors recommend the recommended savings amount rather than minimum to avoid financial stress during Tokyo transition.

Initial Setup Costs: What You Need to Pay Before Moving to Tokyo

Your initial setup costs before moving to Tokyo include several mandatory and optional expenses. The largest is typically housing upfront payments (4-6 months rent), but you must also budget for visa processing, flight tickets, temporary accommodation, basic furnishings, and administrative setup. This comprehensive breakdown helps you calculate exactly how much cash you need during your first month in Tokyo before receiving your first paycheck.

Detailed Initial Cost Breakdown for Tokyo Move

| Expense Category | Single Person | Couple | Family of 4 | Timeline |

|---|---|---|---|---|

| Housing Upfront (4-6 months rent) | 4,000-9,000 (¥600K-1.35M JPY) | 6,000-15,000 (¥900K-2.25M JPY) | 10,000-25,000 (¥1.5M-3.75M JPY) | Before move-in |

| Temporary Accommodation (2-4 weeks) | 800-2,000 (¥120K-300K JPY) | 1,200-3,000 (¥180K-450K JPY) | 2,000-5,000 (¥300K-750K JPY) | First month |

| Basic Furniture & Essentials | 1,500-3,000 (¥225K-450K JPY) | 2,500-5,000 (¥375K-750K JPY) | 5,000-10,000 (¥750K-1.5M JPY) | First month |

| Visa & Immigration Costs | 500-3,000 (¥75K-450K JPY) | 800-5,000 (¥120K-750K JPY) | 1,500-8,000 (¥225K-1.2M JPY) | Before departure |

| Flight Tickets to Tokyo | 800-2,000 (¥120K-300K JPY) | 1,600-4,000 (¥240K-600K JPY) | 3,200-8,000 (¥480K-1.2M JPY) | Before departure |

| Initial Groceries & Household | 300-600 (¥45K-90K JPY) | 500-1,000 (¥75K-150K JPY) | 800-1,600 (¥120K-240K JPY) | First week |

| Transportation Setup | 100-300 (¥15K-45K JPY) | 150-500 (¥22.5K-75K JPY) | 200-800 (¥30K-120K JPY) | First week |

| Communication Setup | 200-500 (¥30K-75K JPY) | 300-800 (¥45K-120K JPY) | 500-1,200 (¥75K-180K JPY) | First week |

| Administrative Fees | 200-500 (¥30K-75K JPY) | 300-700 (¥45K-105K JPY) | 500-1,500 (¥75K-225K JPY) | First month |

| Total Initial Setup Costs | 8,400-21,900 (¥1.26M-3.29M JPY) | 13,450-34,000 (¥2.02M-5.1M JPY) | 23,700-61,100 (¥3.56M-9.17M JPY) | Before/During First Month |

Housing Upfront Costs: Tokyo's 4-6 Months Rent Reality

Tokyo housing upfront costs represent your largest initial expense. Standard requirements: First month's rent (paid in advance), Security deposit (1-2 months, partially refundable), Key money (1-2 months, non-refundable gift to landlord), Real estate agent fee (1 month + 10% tax), Guarantor company fee (0.5-1 month, often required for foreigners), Lock change fee (100-300/¥15K-45K JPY), and Fire insurance (100-200/¥15K-30K JPY annually). Total: 4-6 months rent paid before move-in. Some apartments require last month's rent in advance, increasing upfront costs further.

Temporary Accommodation While Apartment Hunting

Budget 800-5,000 (¥120K-750K JPY) for temporary accommodation in Tokyo while apartment hunting. Options: Weekly mansions (600-1,200/¥90K-180K JPY monthly), Business hotels (1,500-3,000/¥225K-450K JPY monthly), Share house trial (500-800/¥75K-120K JPY monthly), Airbnb (1,000-4,000/¥150K-600K JPY monthly), Guest houses (800-1,500/¥120K-225K JPY monthly). Most foreigners need 2-4 weeks temporary housing while completing apartment applications, which require Japanese bank account, phone number, and in-person visits - catch-22 situation requiring temporary solution.

Tokyo Emergency Fund: How Much Cash Reserve You Really Need

Your Tokyo emergency fund is separate from initial setup costs and covers living expenses during unexpected situations. Financial experts recommend 3-6 months of Tokyo living expenses as an emergency reserve. This fund protects against job loss, medical emergencies, or unexpected costs during your transition. Your emergency savings for Tokyo should be liquid (cash or easily accessible) and not invested, ensuring immediate availability when needed in Japan.

Emergency Fund Calculation Based on Tokyo Living Costs

| Household Type | Monthly Expenses | 3-Month Emergency Fund | 6-Month Emergency Fund | Recommended Minimum |

|---|---|---|---|---|

| Single Person (Frugal) | $1,600 (¥240K JPY) | $4,800 (¥720K JPY) | $9,600 (¥1.44M JPY) | $5,000 (¥750K JPY) |

| Single Person (Comfortable) | $2,800 (¥420K JPY) | $8,400 (¥1.26M JPY) | $16,800 (¥2.52M JPY) | $9,000 (¥1.35M JPY) |

| Couple (Frugal) | $2,600 (¥390K JPY) | $7,800 (¥1.17M JPY) | $15,600 (¥2.34M JPY) | $8,000 (¥1.2M JPY) |

| Couple (Comfortable) | $4,200 (¥630K JPY) | $12,600 (¥1.89M JPY) | $25,200 (¥3.78M JPY) | $13,000 (¥1.95M JPY) |

| Family of 4 (Frugal) | $4,000 (¥600K JPY) | $12,000 (¥1.8M JPY) | $24,000 (¥3.6M JPY) | $13,000 (¥1.95M JPY) |

| Family of 4 (Comfortable) | $6,500 (¥975K JPY) | $19,500 (¥2.93M JPY) | $39,000 (¥5.85M JPY) | $20,000 (¥3M JPY) |

When You'll Need Your Tokyo Emergency Fund

Common situations requiring emergency funds in Tokyo: Job transition period (1-3 months between jobs), Medical emergency co-payments (30% of costs with national insurance), Unexpected housing issues (need to move suddenly, repair costs), Family emergency travel (last-minute flights home), Legal/visa issues (unexpected documentation costs), Natural disasters (earthquake preparedness, temporary evacuation). Japan's social safety nets have limitations for foreigners, making personal emergency funds essential for financial security in Tokyo.

Emergency Fund vs Initial Savings: Key Differences

Initial savings for moving to Tokyo cover planned setup costs (housing, furniture, flights). Emergency fund for Tokyo covers unexpected situations and living expenses during income interruption. These should be separate financial buckets. Example: You have 20,000 total - 12,000 for initial setup, $8,000 emergency fund. Never dip into emergency fund for planned expenses. Build emergency fund first, then save for relocation costs. Maintain emergency fund throughout your Tokyo stay, replenishing if used.

Monthly Living Expense Calculator: How Long Will Your Savings Last?

To determine how long your savings will last in Tokyo, calculate your monthly living expenses based on lifestyle choices. This calculator helps estimate your Tokyo runway - how many months you can survive on savings alone. Essential knowledge for planning your move, especially if job hunting after arrival. Your monthly burn rate in Tokyo determines how much savings you need before moving to Japan.

Tokyo Monthly Expense Calculator Worksheet

| Expense Category | Frugal Budget | Moderate Budget | Comfortable Budget | Your Estimate |

|---|---|---|---|---|

| Housing Rent | 500-800 (¥75K-120K JPY) | 1,000-1,500 (¥150K-225K JPY) | 1,800-2,500 (¥270K-375K JPY) | $_________ |

| Utilities (Electric, Gas, Water) | 120-180 (¥18K-27K JPY) | 180-250 (¥27K-37.5K JPY) | 250-400 (¥37.5K-60K JPY) | $_________ |

| Food & Groceries | 250-400 (¥37.5K-60K JPY) | 400-600 (¥60K-90K JPY) | 600-900 (¥90K-135K JPY) | $_________ |

| Transportation | 80-120 (¥12K-18K JPY) | 120-200 (¥18K-30K JPY) | 200-400 (¥30K-60K JPY) | $_________ |

| Health Insurance | 100-200 (¥15K-30K JPY) | 200-300 (¥30K-45K JPY) | 300-500 (¥45K-75K JPY) | $_________ |

| Phone & Internet | 40-80 (¥6K-12K JPY) | 80-120 (¥12K-18K JPY) | 120-200 (¥18K-30K JPY) | $_________ |

| Entertainment & Dining | 100-200 (¥15K-30K JPY) | 300-500 (¥45K-75K JPY) | 500-1,000 (¥75K-150K JPY) | $_________ |

| Miscellaneous | 100-200 (¥15K-30K JPY) | 200-400 (¥30K-60K JPY) | 400-800 (¥60K-120K JPY) | $_________ |

| Total Monthly Expenses | 1,290-2,180 (¥194K-327K JPY) | 2,480-3,870 (¥372K-581K JPY) | 4,170-6,700 (¥626K-1.01M JPY) | $_________ |

How Long Will Your Savings Last in Tokyo? (Runway Calculator)

Savings Runway Formula: (Total Savings - Initial Setup Costs) ÷ Monthly Expenses = Months of Runway. Example: 20,000 savings - 12,000 initial setup = 8,000 remaining. 8,000 ÷ $2,000 monthly expenses = 4 months runway. Minimum recommended runway: 3-4 months for job seekers, 6+ months for entrepreneurs/remote workers. Critical consideration: Tokyo job hunting typically takes 1-4 months for foreigners, plus 1-2 months for first paycheck after starting. Minimum 6-month runway recommended for job seekers without pre-arranged employment.

Reducing Monthly Expenses to Extend Your Tokyo Runway

Strategies to reduce monthly expenses in Tokyo and extend savings: Housing: Choose share house (500-800 vs $1,200+ for apartment), suburban location (20-40% cheaper), older building. Food: Cook at home, shop at discount supermarkets, buy in-season local produce. Transportation: Use bicycle for local trips, monthly commuter pass for regular routes. Utilities: Reduce air conditioning use, LED bulbs, gas heating instead of electric. Entertainment: Free attractions, parks, hiking, library. Each 10% reduction extends your runway by approximately 1 month for every 10 months of planned expenses.

Tokyo Housing Upfront Costs: Complete Payment Breakdown

Understanding Tokyo housing upfront costs is critical for determining how much money you need before moving to Tokyo. Japan's unique rental system requires substantial cash payments before receiving keys. This section breaks down each component, explains payment timing, and provides strategies to reduce these initial housing costs when relocating to Tokyo.

Detailed Breakdown of Tokyo Apartment Upfront Payments

| Payment Component | Amount (Months of Rent) | Approximate Cost Example | Refundable? | Payment Timing |

|---|---|---|---|---|

| First Month's Rent | 1 month | $1,200 (¥180K JPY) | No (used for first month) | Before move-in |

| Security Deposit (Shikikin) | 1-2 months | 1,200-2,400 (¥180K-360K JPY) | Partially (minus deductions) | Before move-in |

| Key Money (Reikin) | 1-2 months | 1,200-2,400 (¥180K-360K JPY) | No (non-refundable gift) | Before move-in |

| Agent Fee (Chukai Tesuryo) | 1 month + 10% tax | $1,320 (¥198K JPY) | No (service charge) | Before move-in |

| Guarantor Company Fee | 0.5-1 month | 600-1,200 (¥90K-180K JPY) | No (annual fee may apply) | Before move-in |

| Lock Change Fee | N/A (fixed) | 100-300 (¥15K-45K JPY) | No | Before move-in |

| Fire Insurance | N/A (annual) | 100-200 (¥15K-30K JPY) | No | Before move-in |

| Last Month's Rent (Some) | 0-1 month | 0-1,200 (¥0-180K JPY) | No (used for last month) | Before move-in |

| Total Upfront Housing Cost | 4-6+ months rent | 4,720-9,100+ (¥708K-1.37M+ JPY) | Partial (deposit only) | Before receiving keys |

Strategies to Reduce Tokyo Housing Upfront Costs

Methods to reduce upfront housing costs in Tokyo: Seek "reikin nashi" apartments (no key money, though rare), Consider UR Housing (no key money, 2 months deposit), Negotiate with landlord (some reduce key money for foreigners), Use bilingual agents who know foreigner-friendly properties, Choose older buildings (often lower key money), Consider share houses/monthly mansions initially (1-2 months deposit), Look for "foreigner-friendly" listings (sometimes designed for international tenants). Remember: Lower upfront costs may mean higher monthly rent or less desirable location.

Timeline: When Each Housing Payment is Due

Tokyo housing payment timeline: Day 1: View apartments with agent. Day 3-5: Submit application with documents. Day 5-7: Application approved, receive payment details. Day 7-10: Transfer all upfront costs to designated accounts. Day 10-14: Sign contract, receive keys. All upfront payments due before receiving keys, typically 1-2 weeks after application approval. Payments usually via bank transfer (furikomi) in Japanese yen. Have funds readily available in Japanese bank account or arrange international transfer with 3-5 business day lead time.

Visa Financial Requirements: Proof of Funds Needed for Tokyo

Japanese visas have specific financial requirements and proof of funds that determine how much money you need before moving to Tokyo. Each visa category has different financial documentation needs. Understanding these requirements helps ensure you have sufficient savings and proper documentation for successful visa application when relocating to Tokyo.

Proof of Funds Requirements by Visa Type

| Visa Type | Minimum Funds Required | Proof Documentation | Additional Requirements | Processing Time |

|---|---|---|---|---|

| Working Holiday Visa | 2,500-3,000 (¥375K-450K JPY) | Bank statements (3-6 months) | Return flight ticket, health insurance | 2-4 weeks |

| Student Visa | 15,000-20,000 (¥2.25M-3M JPY) | Bank statements, sponsor documents | School acceptance, tuition payment proof | 1-3 months |

| Designated Activities (Job Seeking) | 10,000-15,000 (¥1.5M-2.25M JPY) | Bank statements, degree certificates | Japanese language ability, field relevance | 1-2 months |

| Spouse/Dependent Visa | Sponsor income: $30,000+ (¥4.5M+ JPY) | Sponsor's employment proof, tax documents | Marriage/birth certificates, relationship proof | 2-4 months |

| Business Manager Visa | $50,000+ (¥7.5M+ JPY) business capital | Business plan, incorporation documents, bank statements | Office space, detailed business activities | 3-6 months |

| Work Visa (Company Transfer) | No minimum (company sponsors) | Employment contract, company documents | Degree/relevant experience, company financials | 1-3 months |

| Highly Skilled Professional | Points-based (income, education, age) | Employment proof, degree certificates, salary history | 70+ points on assessment scale | 1-2 months |

Preparing Financial Documents for Tokyo Visa Application

Financial documentation for Tokyo visa requires: Bank statements (3-6 months, showing consistent balance), Balance certificates (official bank letter confirming current balance), Tax returns (2-3 years, translated if necessary), Employment verification (for sponsored visas), Sponsorship letters (for family/sponsor situations). Documents must be original or certified copies, translated to Japanese by certified translator, and recent (within 3 months of application). Insufficient or unclear financial documentation is a common reason for Tokyo visa rejection.

Bank Balance vs Income Requirements for Tokyo Visas

Tokyo visas consider both bank balance (savings) and income (earning potential). Student/Working Holiday visas focus on savings balance. Work/Spouse visas focus on income (current or prospective). Business Manager visa requires both business capital and personal living funds. General guideline: Savings should cover 6-12 months of Tokyo living expenses for visas without employment. Income should be 3-5 times monthly rent for housing applications. Document both clearly in your Tokyo visa application.

Savings Timeline: How Long to Save Before Moving to Tokyo

Creating a realistic savings timeline before moving to Tokyo helps achieve your financial goals. The timeline depends on your current income, expenses, target savings amount, and moving date. This section provides sample savings plans, timeline calculations, and strategies to accelerate your savings for Tokyo relocation.

Sample Savings Timelines for Tokyo Move

| Target Savings | Monthly Savings | Timeline to Save | Accelerated Timeline | Strategies |

|---|---|---|---|---|

| $10,000 (¥1.5M JPY) | $500/month | 20 months | 10 months ($1,000/month) | Reduce discretionary spending, side income |

| $15,000 (¥2.25M JPY) | $750/month | 20 months | 12 months ($1,250/month) | Downsize housing, sell unused items |

| $20,000 (¥3M JPY) | $1,000/month | 20 months | 13 months ($1,500/month) | Reduce transportation costs, freelance work |

| $25,000 (¥3.75M JPY) | $1,250/month | 20 months | 15 months ($1,667/month) | Meal preparation, cancel subscriptions |

| $30,000 (¥4.5M JPY) | $1,500/month | 20 months | 18 months ($1,667/month) | Temporary second job, investment income |

| $40,000 (¥6M JPY) | $2,000/month | 20 months | 24 months ($1,667/month) | Major lifestyle changes, relocation to cheaper area first |

Creating Your Personalized Tokyo Savings Plan

Steps to create personalized Tokyo savings plan: 1. Calculate target amount based on household and lifestyle. 2. Assess current savings and gap to target. 3. Analyze current finances (income, fixed expenses, discretionary spending). 4. Set monthly savings goal (target ÷ months until move). 5. Identify reduction opportunities (housing, transportation, subscriptions, dining). 6. Increase income sources (overtime, side jobs, selling assets). 7. Open dedicated savings account for Tokyo fund. 8. Automate transfers to savings account each payday. 9. Track progress monthly and adjust as needed. 10. Account for exchange rate fluctuations when converting to yen.

Accelerating Your Tokyo Savings Timeline

Strategies to accelerate Tokyo savings timeline: Extreme budgeting (50-70% savings rate), Geographic arbitrage (move to cheaper area before Tokyo), Skill monetization (freelance, consulting, online teaching), Asset liquidation (sell car, electronics, collectibles), Housing optimization (downsize, get roommate, move with family temporarily), Transportation reduction (sell car, use bicycle/public transit), Subscription elimination (cancel all non-essential services), Meal optimization (cook at home, reduce dining out), Side businesses (e-commerce, gig economy, seasonal work). Each 10% increase in savings rate reduces timeline by approximately 1 month per $1,000 target.

Real Budget Scenarios: How Much Real People Saved for Tokyo

Examining real budget scenarios for Tokyo moves provides practical insights into how much money people actually needed before relocating. These real-world examples cover different situations, showing initial savings, actual expenses, and lessons learned. Use these scenarios to benchmark your own Tokyo savings target and avoid common financial pitfalls.

Tokyo Moving Budget Scenarios: Real Examples

| Scenario | Initial Savings | Actual Costs | Remaining After 3 Months | Key Lessons |

|---|---|---|---|---|

| Single, IT job in Shinjuku | $18,000 (¥2.7M JPY) | $14,200 (¥2.13M JPY) | $3,800 (¥570K JPY) | Company covered key money; emergency fund essential |

| Couple, English teachers | $22,000 (¥3.3M JPY) | $19,500 (¥2.93M JPY) | $2,500 (¥375K JPY) | Housing cost more than expected; shared initially better |

| Family of 3, corporate transfer | $35,000 (¥5.25M JPY) | $32,000 (¥4.8M JPY) | $3,000 (¥450K JPY) | Company covered housing; international school deposits huge |

| Single, student in language school | $20,000 (¥3M JPY) | $18,500 (¥2.78M JPY) | $1,500 (¥225K JPY) | Tuition paid separately; part-time job took 2 months to find |

| Couple, digital nomads | $30,000 (¥4.5M JPY) | $24,000 (¥3.6M JPY) | $6,000 (¥900K JPY) | Monthly mansion first; income continued during move |

| Single, working holiday | $8,000 (¥1.2M JPY) | $7,200 (¥1.08M JPY) | $800 (¥120K JPY) | Share house essential; job found in 6 weeks; very tight budget |

Case Study: Single Professional Moving to Tokyo with $15,000

Background: 28-year-old software developer with job offer in Minato ward. Initial savings: 15,000 (¥2.25M JPY). Breakdown: Housing upfront: 7,200 (1-bedroom, 6 months upfront), Temporary hotel: 900 (2 weeks), Flight: 850, Furniture: 2,100, Visa/administrative: 800, Initial groceries/essentials: 450, Emergency fund remaining: 2,700. Timeline: Moved with job starting 2 weeks after arrival. First paycheck received 6 weeks after start date. Key insight: Emergency fund lasted until first paycheck with 1,200 remaining. Recommendation: Have at least 3,000 emergency fund if starting job immediately upon Tokyo arrival.

Case Study: Family of 4 Moving to Tokyo with $40,000

Background: Family with two children (8 and 10), corporate relocation to Chiyoda ward. Initial savings: 40,000 (¥6M JPY). Breakdown: Housing upfront: 18,000 (3-bedroom, 6 months upfront), Temporary serviced apartment: 4,800 (1 month), Flights: 3,600, School deposits: 5,000, Furniture/shipping: 4,500, Visa/administrative: 1,500, Initial setup: 1,600, Emergency fund remaining: 1,000. Company support: Covered 15,000 housing allowance and 5,000 relocation bonus. Key insight: International school required 8,000 deposit (only 5,000 from savings). Family needed additional 7,000 from emergency funds before first paycheck. Recommendation: Families need $10,000+ emergency fund beyond calculated costs.

Money Management Tips Before Moving to Tokyo

- Start saving early: Begin Tokyo savings fund 12-24 months before planned move. Open dedicated high-yield savings account. Automate monthly transfers. Track progress with spreadsheet or budgeting app. Visualize goals with Tokyo-themed savings tracker.

- Reduce expenses aggressively: Cut discretionary spending by 30-50%. Cancel unused subscriptions. Reduce dining out frequency. Optimize grocery spending. Downsize housing if possible. Use public transportation instead of car. Sell unnecessary possessions for extra cash.

- Increase income streams: Pursue overtime at current job. Start side business or freelance work. Monetize skills (tutoring, consulting, crafts). Take temporary second job. Participate in gig economy (driving, delivery, tasks). Rent out spare room or parking space.

- Research Tokyo costs thoroughly: Study current Tokyo prices for housing, food, transportation. Use cost of living calculators. Join Tokyo expat forums for real-time information. Follow Japan living blogs and YouTube channels. Connect with people already in Tokyo for insights.

- Build credit history: Ensure good credit score for potential loan needs. Pay all bills on time. Reduce credit card balances. Avoid new credit applications 6 months before move. Obtain credit report to address any issues. Japanese banks may review home country credit.

- Plan currency exchange strategy: Monitor USD-JPY exchange rates. Use services like Wise (TransferWise) for better rates than banks. Time larger transfers during favorable rates. Avoid airport/tourist exchange counters. Consider multi-currency account for holding yen.

- Prepare financial documents: Gather 6+ months bank statements. Obtain official balance certificates. Secure employment verification letters. Collect tax returns (2-3 years). Translate documents if needed. Make multiple certified copies for visa applications.

- Arrange banking transition: Notify home bank of international move. Ensure online banking access from abroad. Obtain credit/debit cards with no foreign transaction fees. Set up international wire capability. Research Japanese bank options for foreigners. Consider online banks as backup.

- Purchase travel insurance: Buy comprehensive travel insurance covering first 1-3 months in Tokyo. Ensure coverage includes health, luggage, trip interruption. Bridge gap until Japanese national health insurance begins. Read policy details carefully for Japan coverage.

- Create detailed moving budget: List every expected expense with cost estimates. Add 20% buffer for unexpected costs. Categorize as pre-move, initial setup, monthly expenses. Update budget monthly as plans evolve. Share budget with family members involved in move.

- Sell or store possessions strategically: Sell items that are expensive to ship. Calculate shipping vs replacement costs for Tokyo. Consider sentimental vs practical value. Arrange storage for items staying behind. Document all items for insurance and customs.

- Understand tax implications: Consult tax professional about home country filing requirements. Learn about Japan's tax system for residents. Understand dual taxation treaties. Plan for potential tax liabilities in both countries. Keep records of all moving-related expenses for potential deductions.

- Practice living on Tokyo budget: 3-6 months before move, try living on projected Tokyo budget. Adjust to lower dining out frequency. Practice cooking economical meals at home. Use public transportation exclusively. Build frugal habits before arriving in Tokyo.

- Emergency fund prioritization: Build emergency fund before saving for discretionary items. Keep emergency fund in liquid, accessible account. Calculate based on 3-6 months Tokyo expenses. Don't touch emergency fund for planned expenses. Replenish immediately if used.

- Final financial checklist 1 month before: Confirm all funds transferred/accessible. Notify banks/credit card companies of travel dates. Set up account alerts for unusual activity. Arrange for bill payments during transition. Exchange initial cash for airport/taxi expenses. Photograph all important documents as backup.

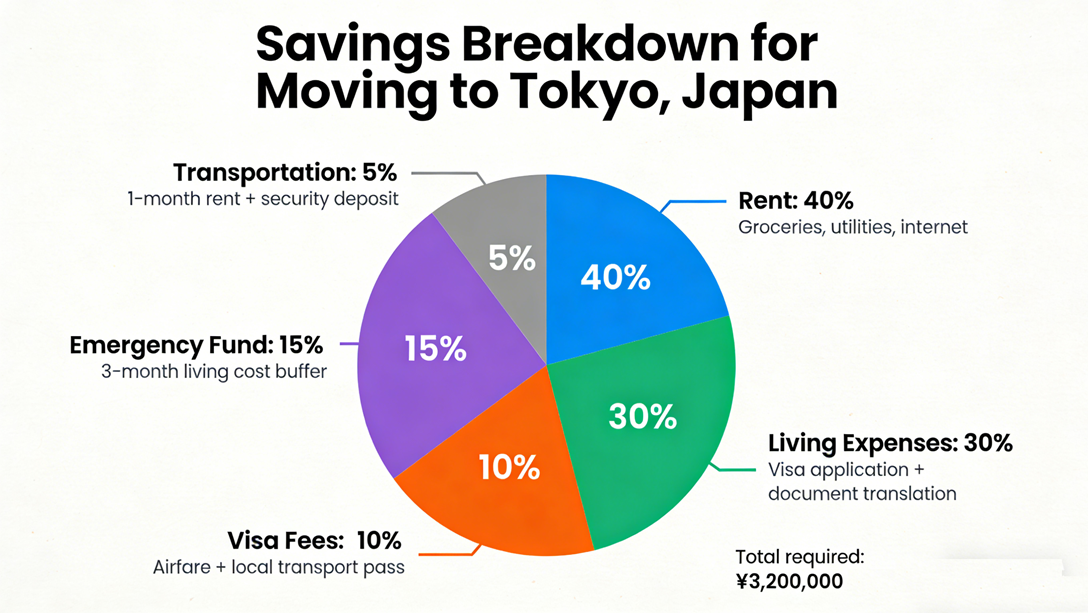

Infographic showing savings timeline, budget allocation, and financial preparation checklist for moving to Tokyo, Japan.

Frequently Asked Questions: Money Needed Before Moving to Tokyo

How much money should I have saved before moving to Tokyo?

Minimum savings before moving to Tokyo: 10,000-15,000 (¥1.5M-2.25M JPY) for singles, 15,000-25,000 (¥2.25M-3.75M JPY) for couples, 25,000-40,000 (¥3.75M-6M JPY) for families. This covers initial setup costs plus 3-6 months of living expenses as a financial safety net while establishing yourself in Tokyo. Actual amount depends on housing choices, lifestyle, and employment situation upon arrival.

What is the minimum amount to move to Tokyo?

Absolute minimum to move to Tokyo: 8,000 (¥1.2M JPY) for singles, 12,000 (¥1.8M JPY) for couples. This covers basic initial setup with shared housing, minimal furniture, and 2 months living expenses. Not recommended - this provides no safety buffer for unexpected expenses. $15,000+ (¥2.25M+ JPY) provides safer transition with emergency fund for job search period, medical needs, or housing issues in Tokyo.

How much cash do I need for Tokyo apartment upfront costs?

Tokyo apartment upfront costs require 4-6 months rent in cash: 4,000-9,000 (¥600K-1.35M JPY) for singles, 6,000-15,000 (¥900K-2.25M JPY) for couples, 10,000-25,000 (¥1.5M-3.75M JPY) for families. This includes first month's rent, security deposit, key money (non-refundable gift), agent fees, and guarantor company fees - all paid before receiving keys to your Tokyo apartment.

How many months of savings do I need for Tokyo?

You need 4-6 months of Tokyo living expenses saved before moving, plus initial setup costs. Single person: save 7,200-16,800 (¥1.08M-2.52M JPY) for 4-6 months expenses. Couple: save 11,200-25,200 (¥1.68M-3.78M JPY). Family: save 18,000-39,000 (¥2.7M-5.85M JPY). This provides financial security during job search or transition period in Tokyo. More conservative approach: save 6-12 months expenses for greater security.

Can I move to Tokyo with $10,000?

Yes, you can move to Tokyo with 10,000 (¥1.5M JPY) but with significant limitations. This covers shared housing (500-800/month), minimal setup, and 3-4 months expenses with strict budgeting. Not recommended for families or those without immediate employment. Requires frugal lifestyle, shared housing, and immediate income. 15,000+ (¥2.25M+ JPY) provides more comfortable transition with safety buffer for Tokyo's unexpected costs and longer job search if needed.

How much emergency fund do I need for Tokyo?

Tokyo emergency fund requirement: 3-6 months of living expenses. Single person: 5,400-10,800 (¥810K-1.62M JPY). Couple: 8,400-16,800 (¥1.26M-2.52M JPY). Family of 4: 13,500-27,000 (¥2.03M-4.05M JPY). This covers unexpected job loss, medical expenses, or emergencies while establishing financial stability in Tokyo. Keep emergency fund in liquid account (not invested) for immediate access when needed in Japan.

Should I have a job before moving to Tokyo?

Highly recommended to secure employment before moving to Tokyo. Japan requires proof of income/sponsorship for most visas. Without pre-arranged job, you need substantial savings ($20,000+/¥3M+ JPY) and must qualify for specific visas (Working Holiday, Student, Business Manager). Job hunting from abroad is challenging - most employers prefer candidates already in Japan. Some exceptions: intra-company transfers, highly specialized fields with recruitment agencies, or digital nomads with stable remote income.

What proof of funds do I need for Tokyo visa?

Proof of funds requirements for Tokyo visas: Working Holiday visa requires 2,500-3,000 (¥375K-450K JPY) savings. Student visa requires 15,000-20,000 (¥2.25M-3M JPY) in bank account. Spouse/Dependent visa requires sponsor's income proof. Business Manager visa requires $50,000+ (¥7.5M+ JPY) business capital. Work visa typically requires employment offer rather than personal savings. All require official bank statements, balance certificates, and sometimes tax documents for Tokyo visa application.

How much should I budget for initial Tokyo setup?

Initial Tokyo setup budget: 8,000-12,000 (¥1.2M-1.8M JPY) for singles, 12,000-18,000 (¥1.8M-2.7M JPY) for couples, 20,000-30,000 (¥3M-4.5M JPY) for families. This includes housing deposits, basic furniture, visa costs, initial groceries/essentials, transportation setup, and administrative fees for establishing residence in Tokyo. Add 20% buffer for unexpected costs. This doesn't include shipping belongings or emergency fund - those are separate budget categories.

Is $20,000 enough to move to Tokyo?

20,000 (¥3M JPY) is sufficient for single person or couple moving to Tokyo with careful planning. This covers initial setup (8,000-12,000), 3-4 months living expenses (5,400-7,200), and emergency fund. For families, 20,000 is minimal - 30,000+ (¥4.5M+ JPY) recommended. Success depends on housing choices (shared vs private), lifestyle expectations, and employment timeline. With pre-arranged job and modest housing, 20,000 provides comfortable transition to Tokyo.

What are the hidden costs before moving to Tokyo?

Hidden costs before Tokyo move: International shipping (2,000-8,000/¥300K-1.2M JPY), visa/document preparation (500-3,000/¥75K-450K JPY), flight/transportation (800-2,000/¥120K-300K JPY), health checks/vaccinations (200-800/¥30K-120K JPY), temporary accommodation while apartment hunting (1,000-3,000/¥150K-450K JPY), and currency exchange fees (1-3% of transferred funds). These often-overlooked expenses add 5,000-15,000+ to Tokyo relocation costs.

How long will my savings last in Tokyo?

Savings duration in Tokyo: $10,000 (¥1.5M JPY) lasts 4-6 months for singles,3-4 months for couples, 2-3 months for families with strict budgeting. $20,000 (¥3M JPY) lasts 8-12 months singles, 6-8 months couples, 4-6 months families. This assumes moderate lifestyle, shared/suburban housing, cooking at home, and using public transportation in Tokyo.